Multi-Asset Portfolio Construction & Risk Budgeting

Modern web-based platform built with React, powered by a robust Python optimization engine. Purpose-built for SAA/TAA workflows with an intuitive, interactive interface.

Comprehensive Quantitative Analysis Suite

Institutional-grade portfolio construction, risk analytics, and performance attribution

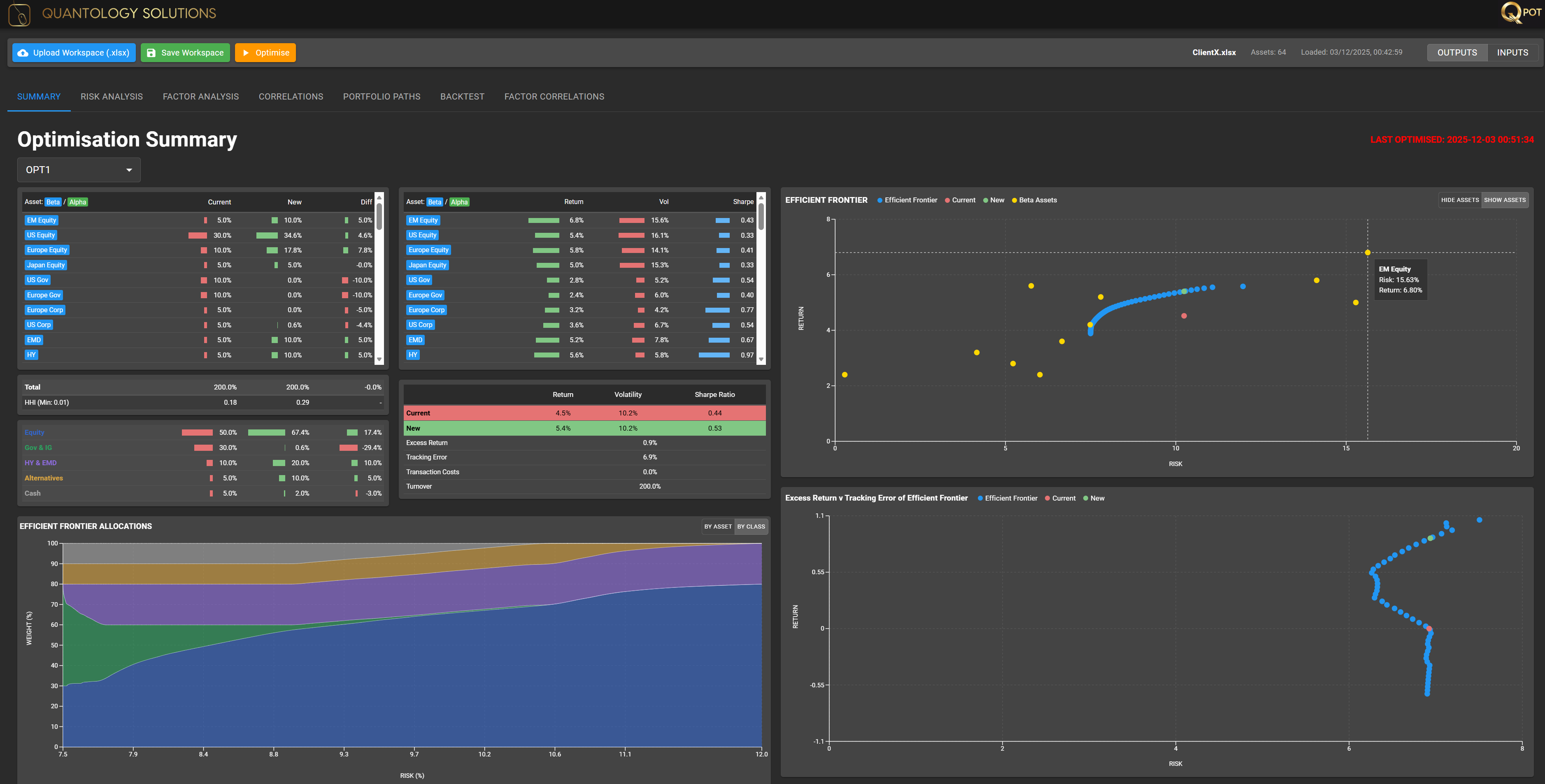

Efficient Frontiers with Custom Constraints

Generate efficient frontiers subject to your forecasts and constraints. Purpose-built for multi-asset SAA/TAA workflows with comprehensive constraint handling.

- Mean-variance optimisation with linear and quadratic constraints

- Custom group ratio constraints and turnover constraints

- Tracking error constraints with transaction cost penalties

- Multiple workspace management with different universes and objectives

- Workflow management for optimisation audit trail

- Alpha-beta allocation and rebalancing analysis

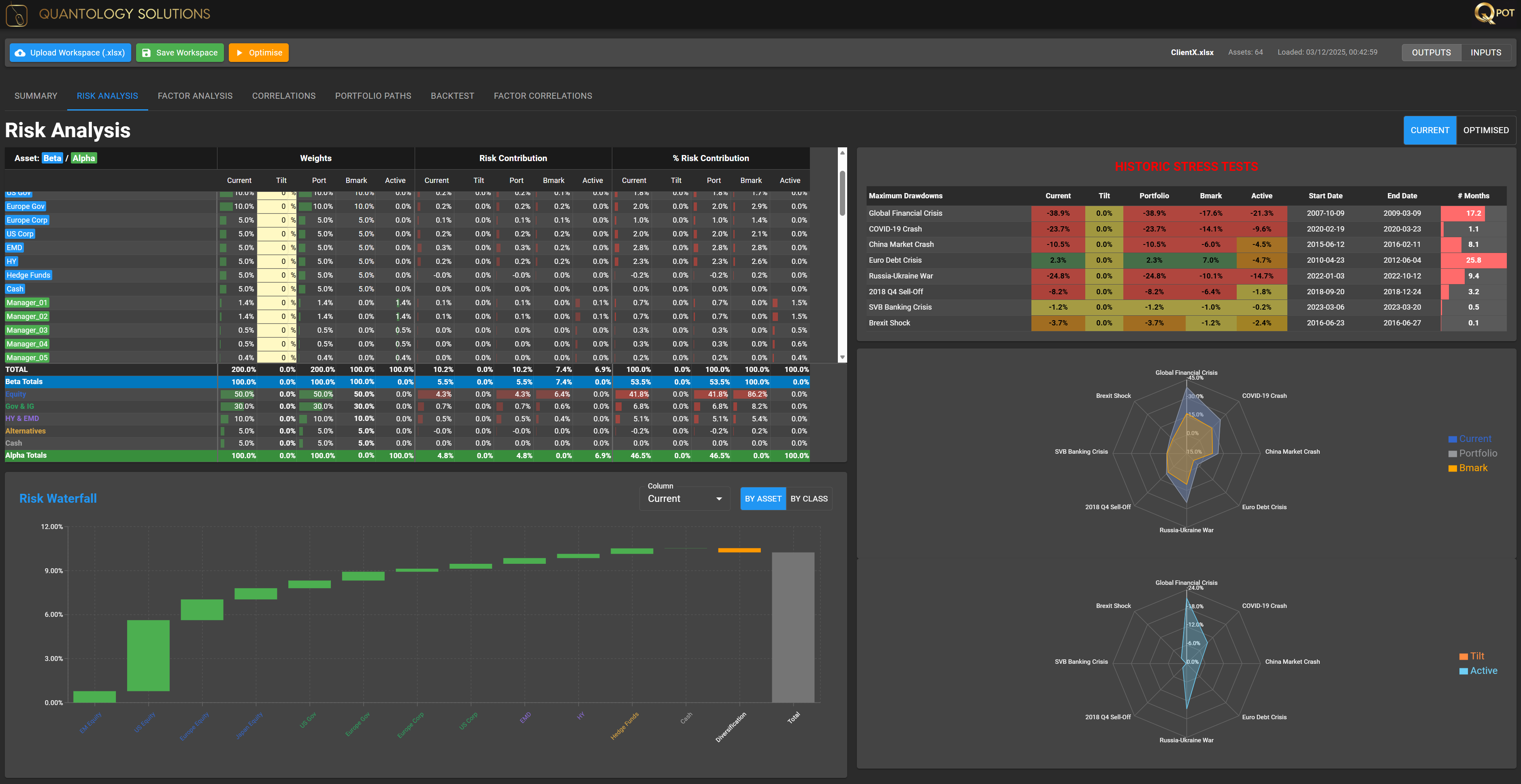

Risk Decomposition & Factor Analysis

What-if analysis to understand the risk impact of your trades. Multi-factor time series regression for macro-factor risk and sensitivity analysis.

- Risk decomposition and historical stress testing vs benchmark

- Active risk decomposition with interactive what-if analysis

- Multi-factor time series regression for macro-factor exposures

- Analysis of optimised, tilted, and benchmark portfolios

- Risk contributions in absolute and active space

- Correlation analysis between alphas and betas

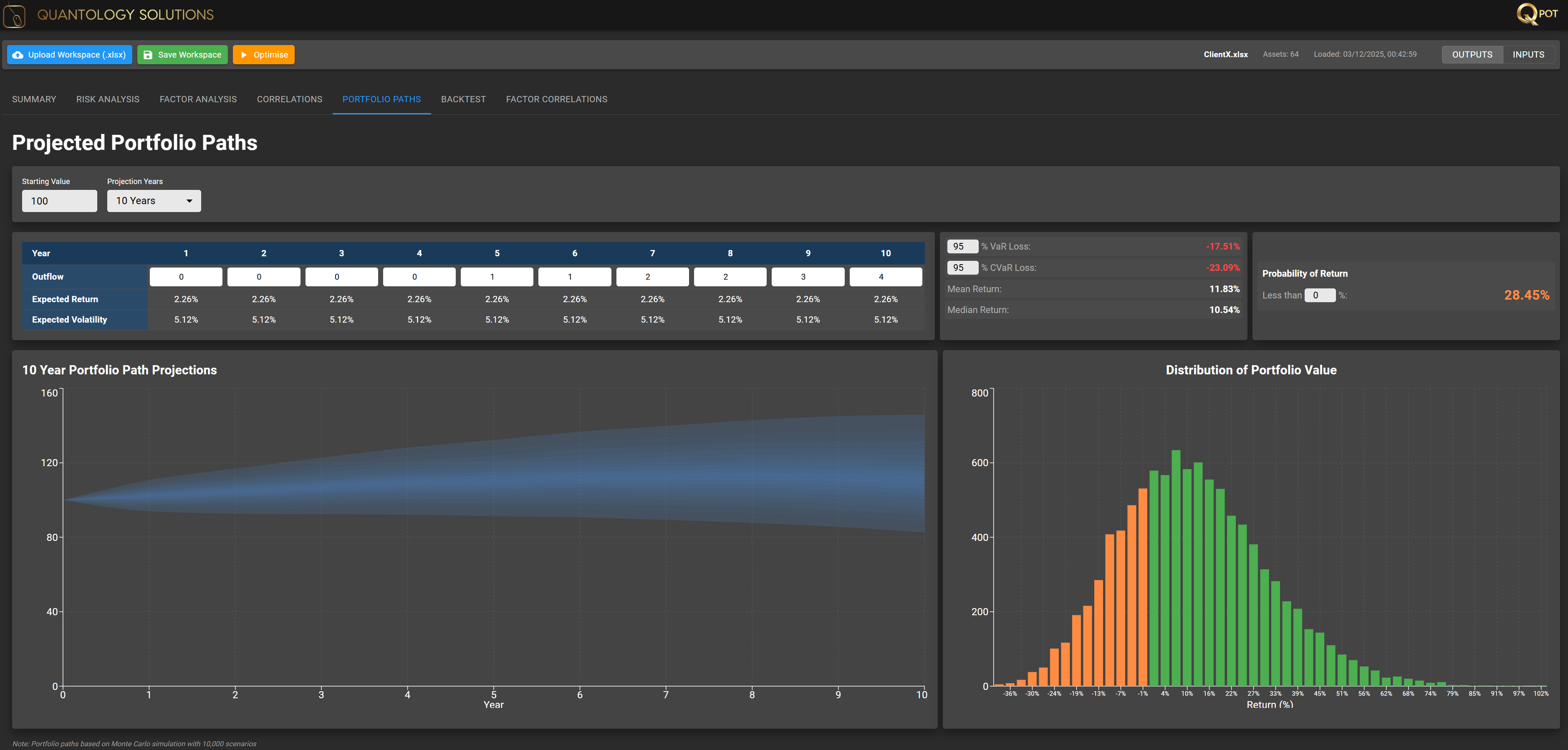

Monte Carlo Projections & Glide Paths

Project your portfolio and identify a glide path to meet your future outcomes. Forward-looking simulations based on expected returns and volatility.

- Monte Carlo simulation of portfolio returns over flexible time horizons

- Value at Risk (VaR) and Conditional VaR estimation

- Return probability analysis over multi-year periods

- Glide path modeling for liability-driven strategies

- Custom allocation paths to meet specific future outcomes

- Risk-return trade-off visualization

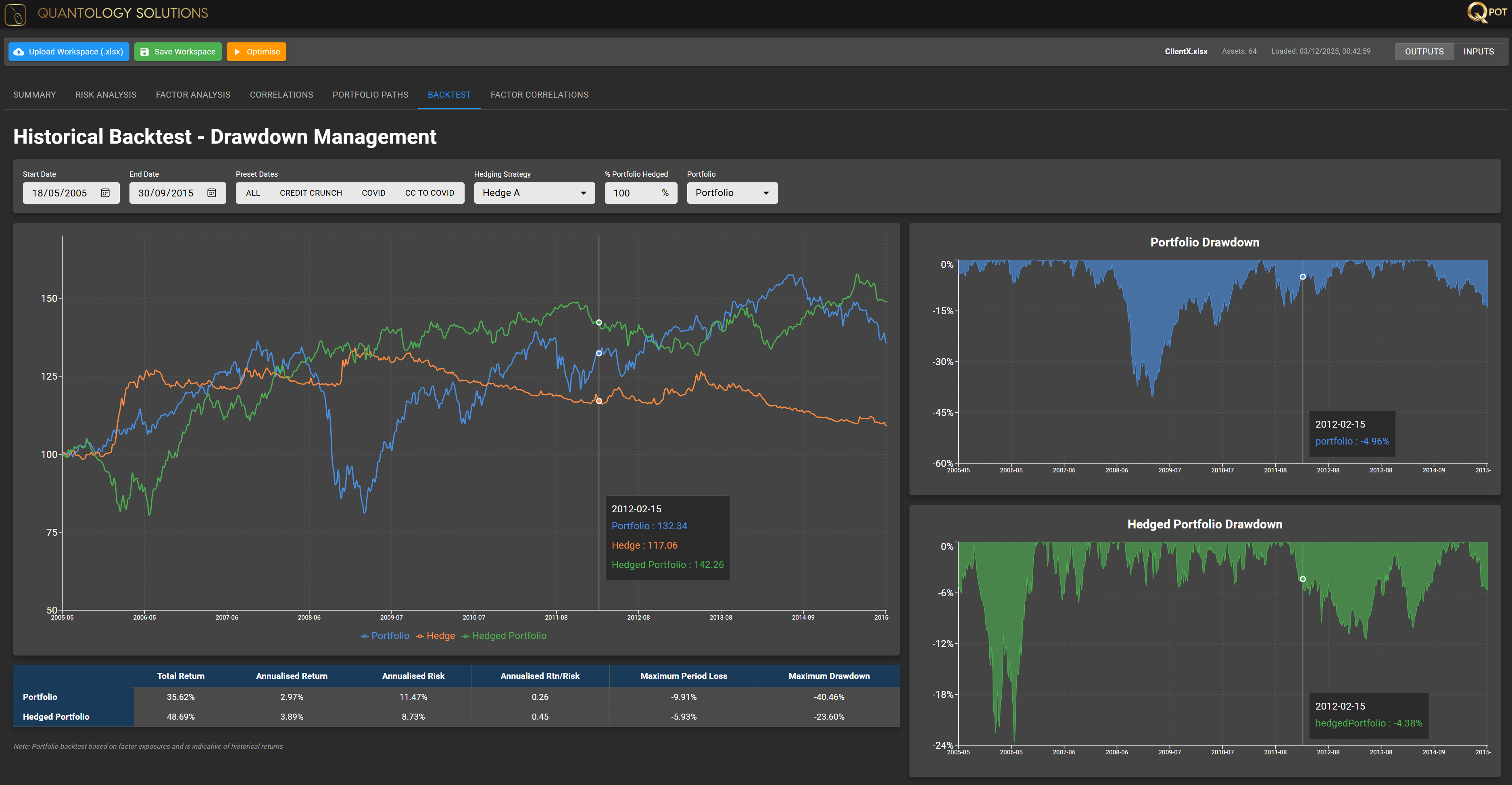

Backtesting & Hedging Strategies

Overlay hedging strategies to mitigate drawdowns and give you a smoother journey. Interactive backtesting with systematic hedge overlays.

- Interactive backtesting tool for historical performance analysis

- Maximum drawdown calculation for selected periods

- Systematic hedging strategy overlay capabilities

- Performance impact analysis of hedge overlays

- Drawdown reduction and smoothing visualization

- Compare hedged vs unhedged portfolio paths

Institutional Power, Intuitive Operation

Advanced AI assistance makes sophisticated quantitative analysis accessible to everyone— no PhD required

AI Assistant for Natural Language Navigation

Interact with QPOT using plain English. Ask questions, make changes, and navigate complex workflows without needing deep technical expertise. The AI Assistant understands your intent and guides you through every step.

- ✓"Add MSCI World with a maximum 30% allocation"

- ✓"Set tracking error limit of 2% for current optimization"

- ✓"Limit total equities to 50%"

- ✓No complex menus—just tell the AI what you need

Complete Transparency—Not a Black Box

Every calculation, assumption, and methodology is fully visible and customizable. Create custom risk lenses tailored to your specific needs with AI-guided configuration.

- ✓Full visibility into all risk models and calculations

- ✓Customizable risk lenses for different perspectives

- ✓AI-assisted configuration of complex methodologies

- ✓Audit trails for all portfolio decisions and changes

Complete Desk Risk Management

Enterprise-grade risk reporting with AI-generated commentary that explains complex analytics in clear, accessible language—automatically customized for your audience.

"The AI writes professional risk commentary that would take hours to produce manually. It understands the context, highlights what matters, and adapts the language whether you're presenting to clients, fund managers, or compliance teams."

- 📝AI-Generated CommentaryProfessional risk narratives automatically generated from your portfolio data

- 👥Audience CustomizationTailor reports for clients, fund managers, compliance, or investment committees

- 🎯Context-Aware AnalysisAI highlights significant changes, risks, and opportunities automatically

- ⚡Instant GenerationProfessional risk reports in seconds, not hours

Democratizing Quantitative Analysis

You no longer need a team of PhDs to run sophisticated portfolio analytics. The AI Assistant handles the complexity while maintaining institutional-grade rigor. Fund managers, advisors, and analysts can now perform advanced quantitative analysis that was previously only accessible to the largest institutions.

Flexible Deployment Options

Choose the deployment model that best fits your infrastructure and requirements

Desktop Application

Standalone desktop-based solution for individual users and small teams

Server Deployment

On-premise server installation for enterprise-wide access and control

Cloud Hosting

Fully managed cloud solution with automatic updates and scaling

White-Label Integration

Fully customized and integrated into your existing platforms and workflows

Custom Architecture

Tailored deployment matching your specific infrastructure requirements

Hybrid Solutions

Combine on-premise and cloud components for optimal flexibility

Technology & Customization

QPOT delivers a modern web interface powered by React and Python. Every implementation is customized to your specific workflow, methodology, and data sources.

Typical Use Cases

- ✓Strategic Asset Allocation (SAA) for multi-asset funds

- ✓Tactical Asset Allocation (TAA) with dynamic rebalancing

- ✓Fund of Funds portfolio construction

- ✓Wealth management model portfolios

- ✓OCIO investment platform workflows

- ✓Pension fund liability-driven investment (LDI)

Ready to Experience QPOT?

Schedule a personalized demo and see how QPOT can transform your portfolio management process